VIVA NETWORK - Review

- Get link

- X

- Other Apps

Hello to all and welcome to my ICO review . For those of you who don't know me yet, let me introduce myself. My name is Funke and I'm an experienced writer who enjoys what he does very much. I'm here to give you all the information you might need or want about The Peer To Peer Mortgage Lending Platform & Tokenized Mortgage Exchange. I plan to make them “easy read, to the point” because what's important to me is that we all comprehend and absorb the information and actually want to be here learning together about something new.

Today, let us all learn and experience together all about VIVA NETWORK. If you don't know anything about them, don't run away, that's why I'm here, to change that within the next few minutes. Before I begin, I just want to quickly mention that I will be including LINKS so that YOU can do your own research or whatever you feel you need. I feel it's best to have all of the information in one place, in an organised manner, rather than dotted about the page making what you want hard to find or confusing. All these links will be put at the BOTTOM of this page to keep things easy.

The Viva Network is a decentralized ecosystem that connects mortgage borrowers with global investors within a borderless, blockchain-secured cloud platform. Viva’s innovative technology uses Ethereum smart contracts to underwrite and securitize private home loans into Fractionalized Mortgage Shares (FMS) which can easily be bought and sold on the Viva FMS Exchange (a Secondary Market Exchange) application.

Using Fractionalized Mortgage Shares, The Viva Network allows investors to crowdfund mortgages of home buyers from anywhere in the world, making the process quicker and easier for home buyers. With the ability to efficiently access the free market, both parties will now be able to capitalize on international interest rate arbitrage and obtain lower interest rate mortgages and higher returns on investments.

The Goal

Viva’s goal is to free millions of borrowers located in regions with high interest rates from their reliance on inefficient local financial systems. The crowd lending transactions are conducted utilizing the newly released “ VIVA ” token, a blockchain-powered transfer vehicle, while the ultimate delivery of loans and mortgage repayments will be made in each party’s local fiat currency. Neither the borrower or the lender will require any knowledge of blockchain technology; they will need only use Viva Networks intuitive web platform. Importantly, neither party will be exposed to cryptocurrency fluctuation risk.

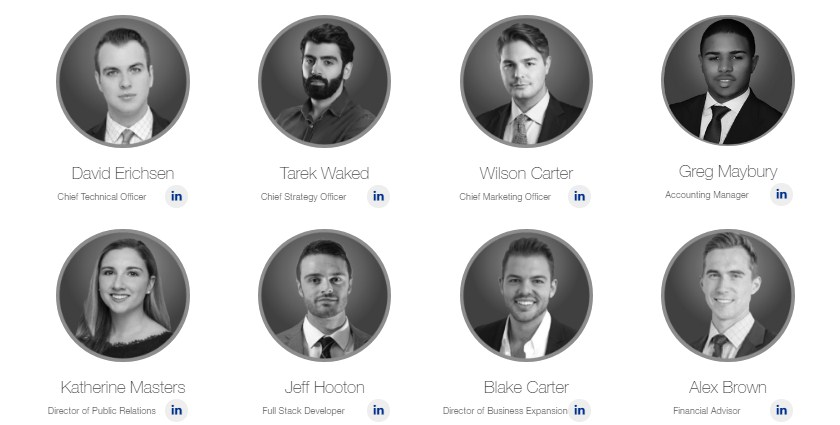

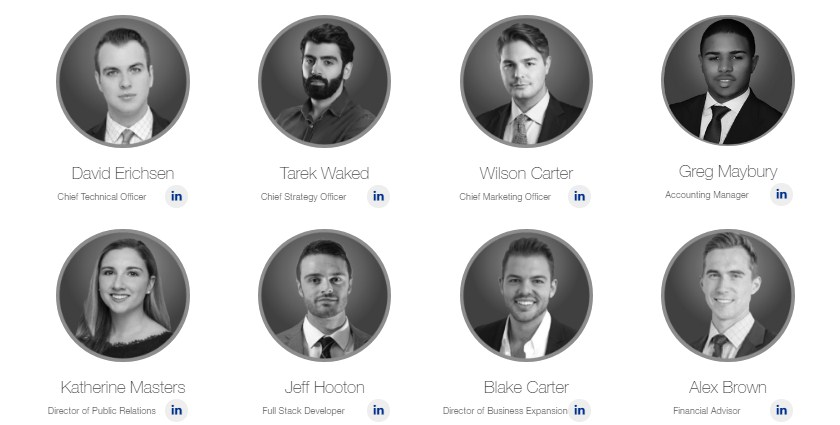

I am going to get straight to the point of who they are since this is such an important factor, as I like to put it, “The Brains behind VIVA NETWORK”. If the team behind the product or service in question haven't the resources or knowledge, then we know the product or service delivered will possibly not have the quality it should have. We need to know two very important things when we look at a new starting up company:

Who are the people/team behind this?

What experience and knowledge do they possess?

Who are the people/team behind this?

What experience and knowledge do they possess?

Okay, so, because I've already done all the research needed beforehand and thoroughly VIVA NETWORK I can very happily confirm that this company has a fabulous team onboard. Here they are:

The project team believes that Viva's technology will increase the availability of loans to borrowers and for the first time does not allow institutional investors to participate in subsequent sales, and supported by assets related to mortgage investments, products, traditionally reserved for large financial institutions.

THE PLATFORM

Viva’s platform will also provide related services such as blockchain-based home valuations via its RV2 valuation product and decentralized credit assessments with its V-Score product.

Viva’s platform will also provide related services such as blockchain-based home valuations via its RV2 valuation product and decentralized credit assessments with its V-Score product.

Viva is just a transformative economic technology which introduces large-scale property mortgage lending to the world. Viva's platform will utilize wise contracts to crowdfund home loans, connecting borrowers and investors directly in just a decentralized, trustless ecosystem. By leveraging ultra-secure blockchain trades, Viva cuts out the middlemen, resulting in a lending process which is more profitable and efficient for all parties.

Viva enables a free market to ascertain the interest rate on a borrower's mortgage and removes the dependence on banks and other financial intermediaries. By eliminating inefficiencies in local financial techniques, mortgage rates will more fairly and accurately reflect the level of danger related to the asset's actual value.

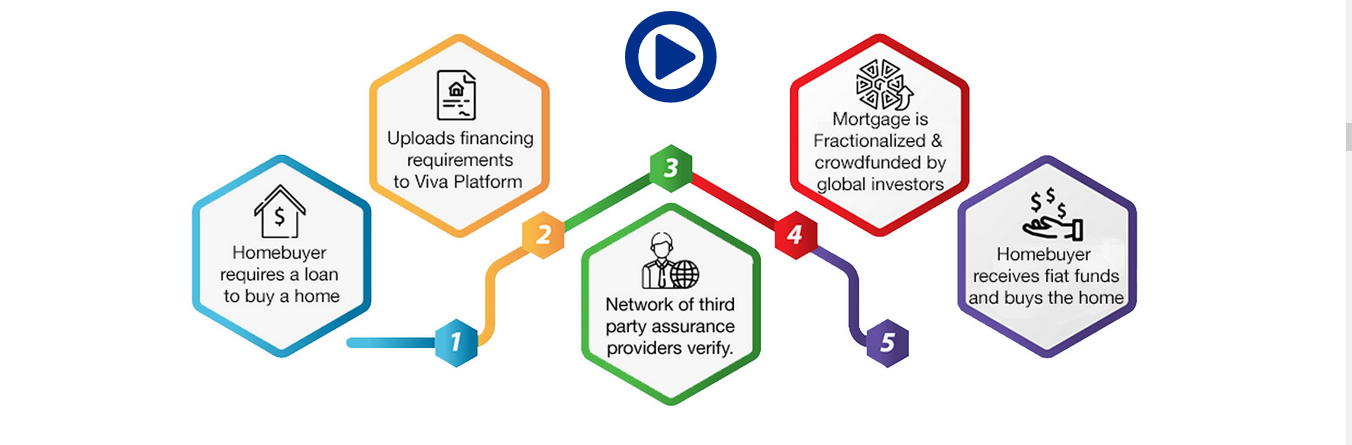

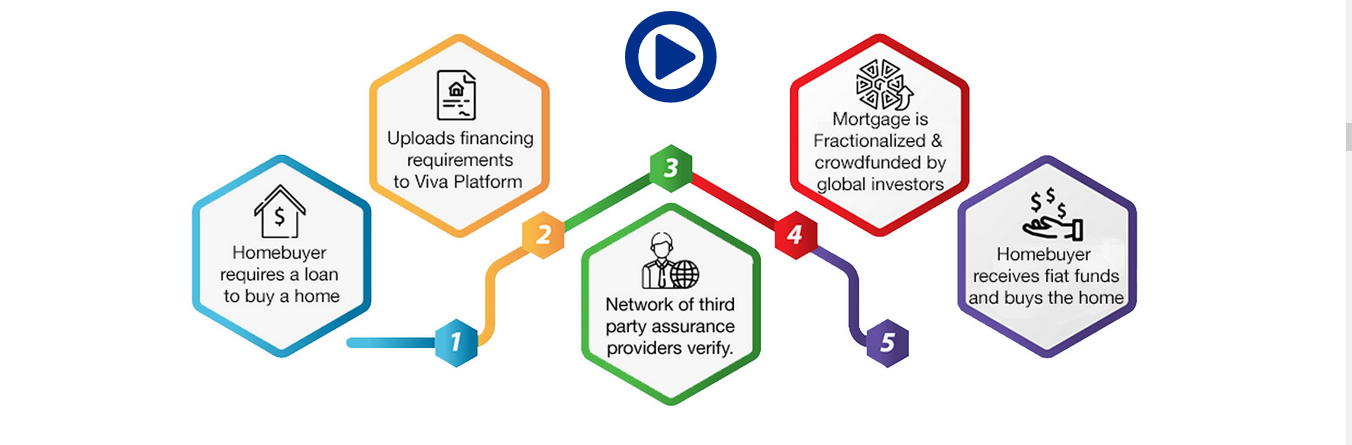

HOW IT WORKS

Using stock shredding mortgages, Viva's network allows investors to buy mortgage loans from home buyers from anywhere in the world, making the process faster and easier for home buyers. With the ability to access the free market effectively, both parties will now be able to use international arbitrage with interest rates and receive a mortgage with lower interest rates and higher return on investment.

KEY ELEMENTS

Using stock shredding mortgages, Viva's network allows investors to buy mortgage loans from home buyers from anywhere in the world, making the process faster and easier for home buyers. With the ability to access the free market effectively, both parties will now be able to use international arbitrage with interest rates and receive a mortgage with lower interest rates and higher return on investment.

KEY ELEMENTS

The decision of the Viva Network project will consist of three main elements, or, as their creators say, their three "cornerstones". We already talked about the first and main of them - the financing of mortgage loans for real estate buyers from private investors.

The Viva Network platform, uniting these two participants, will act as a platform for their interaction, basing their cooperation on smart contracts that are responsible for the fulfillment by the parties of their obligations. In particular, it is with the help of smart contracts that the transfer of funds to the account of the buyer and monthly payments to the investor's account.

The second solution, which will be implemented within the framework of Viva Network, is an automated assessment of residential real estate. Using Real Value 2.0 software (RV2), users will be able to get an accurate estimate of the value of a property based on a number of key criteria, including dimensions, location and other housing features.

Remote evaluation of real estate on the basis of the technology of machine learning and artificial intelligence can be carried out directly through the Viva Network platform, paying for this service using Viva Token tokens. In the final part, we'll talk more about this possibility when we review the MVP platform.

The last element of the Viva Network solution is a credit scoring. Its essence consists in assigning each participant of the platform a unique identification number and creating a rating credit system, relying on the indicators of which users can cooperate in reliable and safe conditions.

TOKEN DETAILS

Token: VIVA

Platform: Ethereum

Standard: ERC20

Quantity: 3,000,000,000 VIVA

Price: 35,714 VIVA = 1 ETH

Payment: ETH

Hard cap: 3,000,000,000 VIVA

PreICO

Beginning: 31.03.2018

Completion: 14.04.2018

Bonus: 35%

ICO

Beginning: 14.04.2018

Completion: 14.06.2018

bonus system:

Up to 11,200 ETH - 25%

Up to 33,070 ETH - 15%

Up to 68,700 ETH-no

In conclusion, Viva’s goal is to free millions of borrowers located in regions with high interest rates from their reliance on inefficient local financial systems. The crowd lending transactions are conducted utilizing the newly released “ VIVA ” token, a blockchain-powered transfer vehicle, while the ultimate delivery of loans and mortgage repayments will be made in each party’s local fiat currency. Neither the borrower or the lender will require any knowledge of blockchain technology; they will need only use Viva Networks intuitive web platform. Importantly, neither party will be exposed to cryptocurrency fluctuation risk.

For more information, please visit:

Web site: http://www.vivanetwork.org/

Whitepaper: http://www.vivanetwork.org/pdf/whitepaper.pdf

Twitter: https://twitter.com/TheVivaNetwork

Medium: https://medium.com/@VivaNetwork

Telegram: http://t.me/Wearethevivanetwork

BITCOINTALK PROFILE: https://bitcointalk.org/index.php?action=profile;u=1971452

- Get link

- X

- Other Apps

Comments

Post a Comment